German Equities: Taking Back the Reigns of Europe?

Germany’s potential fiscal support and debt brake reform are creating a supportive environment for German equities—but risks remain on the horizon.

Germany’s recent elections took place against a backdrop of sluggish economic growth and weak business and consumer confidence. This slow growth, in part, reflects ballooning energy costs—particularly problematic in a nation where manufacturing still accounts for 20% of gross value added.1 In addition, Germany’s exports to China have faced increased domestic competition, with domestic brands now representing more than 60% of China’s passenger vehicle market—a key destination for Germany’s important automotive industry.2 In this context, Germany’s shaky and unpopular coalition government had failed to successfully address key issues such as employment and pension reform, energy policy, and defense spending, leaving consumers concerned and voters dissatisfied. These factors place the incoming Chancellor Friedrich Merz in a position where Germany’s electorate is more ready for reform and change to stimulate growth—and following ongoing developments in Ukraine, recognizing the need for leadership within the Eurozone and its unity.

Merz’s initial policy response includes proposing an aggressive 10-year €500 billion investment program covering infrastructure, energy, transport, digitization and education—with the aim of restarting the Germany economy. In addition, Germany is proposing relaxing its constitutionally enshrined ‘debt brake’. The debt brake, implemented under Angela Merkel during the Eurozone crisis days of 2009, limits the federal government’s annual deficit to 0.35% of GDP, after adjusting for the economic cycle.

Today, however, the Bundesbank, the International Monetary Fund, the Organization for Economic Cooperation and Development, Germany’s biggest trade union, and its state-appointed council of economic experts, all agree this cautious approach is no longer serving the country well. Merz’s proposal allows exemptions for spending on defense and special infrastructure projects in excess of 1% of GDP. In practice, this would imply that while defense spending could be set in any one year at 3% of GDP, only the first 1% of this would count toward the debt brake. Although this would likely impact spending in other areas of the economy, it allows for an almost unlimited uplift in defense spending. However, these proposals have yet to be ratified by Germany’s parliament, and will require a two-thirds majority in both Germany’s lower house (Bundestag) and upper house (Bundesrat).

A Likely Increase in Defense Spending

Across Europe, national budgets have progressively de-prioritized defense spending. However, growing talk about a potential ceasefire in Ukraine, combined with the reluctance of the U.S. to fully support or guarantee this peace, have intensified European awareness of the continent’s military shortcomings and reliance on U.S. technology and manpower. The potential requirement for a European-led peacekeeping or deterrent force has rekindled awareness of the security benefits of a more native and self-sufficient European defense industry. As a result, the share prices of European defense and aerospace companies have already risen, anticipating a structural surge in orders as Europe—particularly Germany—re-invests in defense capabilities.

In addition, there is a wide range of other industries and services that are well-positioned to benefit from the boost in demand for defense. For instance, Germany’s mid-sized industrial companies, or Mittelstand, are likely to be crucial in supplying mechanical engineering skills. In addition, providers of communications technology, lasers and technical design services will be essential if Europe commits to enhancing its security self-reliance.

Implications of a €500 Billion Bazooka

The proposed €500 billion investment in infrastructure over 10 years, averaging €50 billion per year, is estimated to be 1.1% of Germany’s expected GDP in 2026.3 However, with construction and infrastructure projects requiring planning, local, State and Federal government approvals, the ultimate spending of funds will likely lead to a gradual increase in demand rather than a sharp jump. Further, spending is likely to spread across a broad range of industries, suggesting potential investment opportunities will become clearer only as the details emerge.

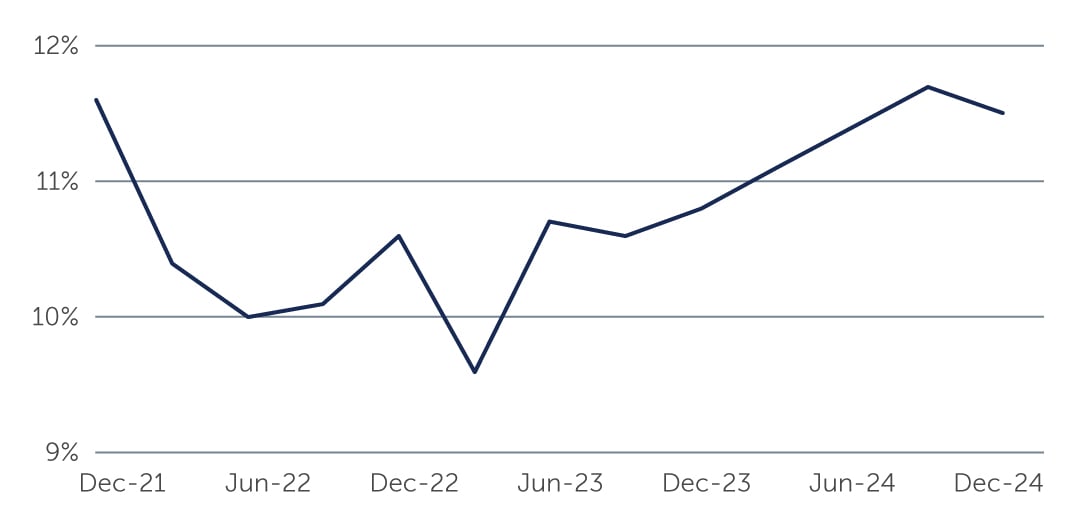

That said, if Germany’s potential domestic economic growth accelerates, business and consumer confidence should recover from current lows. Improving consumer confidence would be beneficial for economic growth and the investment case for Germany. In particular, against the current backdrop of slowing growth and economic and geopolitical uncertainties, household savings rates in Germany have risen to 11.5% (Figure 1).

Figure 1: Germany Household Income – Savings Ratio (%)

Source: Bloomberg. As of December 31, 2024.

Source: Bloomberg. As of December 31, 2024.

A more positive economic environment would likely result in the unlocking of pent-up demand, which could lift GDP more than rising government expenditure. By promoting growth, supply-side reforms should facilitate servicing the extra debt in the future from rising revenues. Encouragingly, sentiment appears already to be improving, with the recent Germany ZEW Economic Sentiment Index surpassing expectations and reaching its highest value since July 2024 (Figure 2).

Figure 2: Germany ZEW Economic Sentiment Index

Source: ZEW. As of February 28, 2025.

Source: ZEW. As of February 28, 2025.

A Supportive Environment for German Equities

Against this backdrop, German equities are likely to be well-supported going forward. In addition, while there is heightened uncertainty around the progress toward a potential ceasefire in Ukraine, a ceasefire could support German equities in three areas:

- In the immediate aftermath, reduced tensions could potentially boost equity market valuations from their current lows compared to historic levels and compared to other countries. In particular, smaller companies are likely to benefit disproportionally due to their sensitivity to volatility.

- A resolution would likely reduce energy prices in Europe, benefitting both the consumer and industry.

- Upward revisions to growth expectations could improve sentiment and encourage investment. Germany’s small and medium-sized companies (SMEs), particularly in the industrial sector, could benefit given that they have a higher proportion of sales and earnings generated domestically. In addition, the relative performance of SMEs is positively correlated to both German growth and industrial activity.

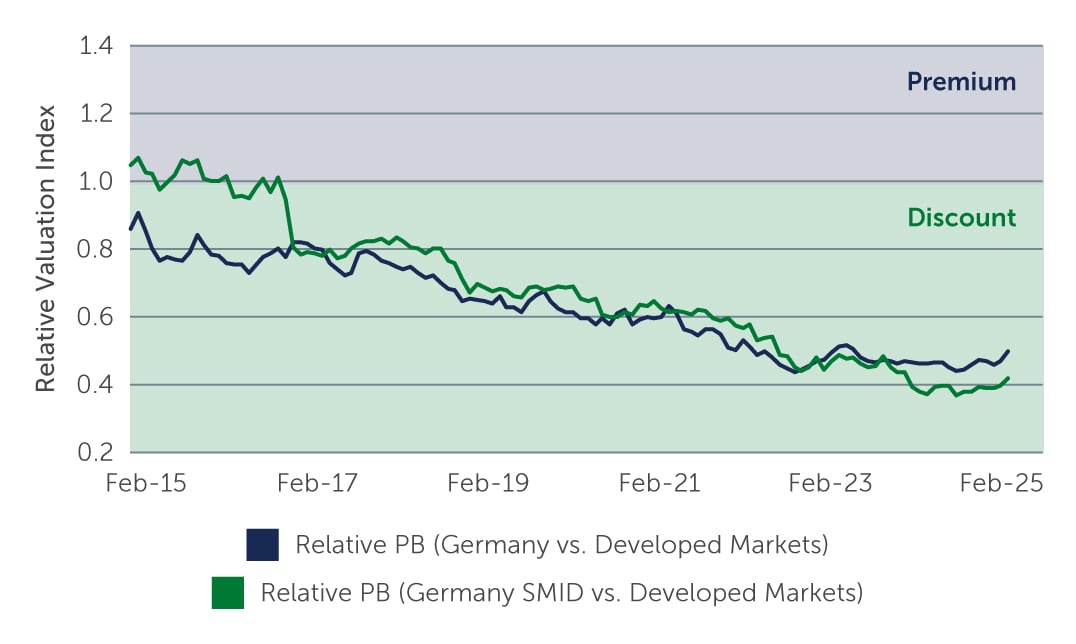

In recent years, valuations of both larger and smaller German companies relative to other developed markets have declined sharply—reflecting geopolitical tensions and weaker economic growth (Figure 3). In our view, current price-to-book valuations and price earnings multiples suggest German equities appear to be attractively valued, particularly if spending and economic growth recover, and sentiment improves.

Figure 3: Relative Price to Book Valuations

Source: Barings, MSCI. As of January 31, 2025. Germany – MSCI Germany, Germany SMID – MSCI Germany SMID, Developed Market – MSCI World.

Source: Barings, MSCI. As of January 31, 2025. Germany – MSCI Germany, Germany SMID – MSCI Germany SMID, Developed Market – MSCI World.

1. Source: Statistisches Bundesamt. As of February 28, 2025.

2. Source: China Association of Automobile Manufacturers, Market Share Data 2024.

3. Source: OECD. As of February 28, 2025. Calculation based on a simple extrapolation of Germany’s current economic output.