CLOs: The Positive Streak Continues

While CLOs remain well-positioned for the months ahead, we continue to see benefits to staying up in both quality and liquidity.

Collateralized loan obligations (CLOs) have continued their positive streak as elevated interest rates and the potential for incremental yield draw investors to the market. Helped by the supportive economic backdrop, performance has remained positive across the capital structure. In the second quarter, AAA, AA and single-A CLOs returned 1.77%, 2.03%, and 2.32%, respectively, while BBB, BB and single-B CLOs returned 2.94%, 4.52%, and 9.50%.1 While volatility could return to the market in the coming months—stemming from political uncertainty, geopolitical tensions or other factors—CLOs remain well-positioned.

Technical Strength

Strong technical forces continue to shape the CLO market, driven in large part by strong demand up and down the capital structure. AAA buyers in particular have continued to return to the market amid a continued appetite for risk assets. U.S. and Japanese banks have led the charge along with insurance companies and asset managers. AAA CLO exchange traded funds (ETFs) have also seen increased inflows, although that dynamic may begin to shift as the U.S. Federal Reserve’s path toward rate-cutting becomes clearer. In addition, there has been an acceleration of principal repayments from amortizations, increasing the demand to re-deploy proceeds into AAA tranches. For mezzanine tranches, the elevated coupons received on the July payment dates—a result of the continued high-rate environment—will provide significant funds to utilize in the market, contributing to a positive technical backdrop.

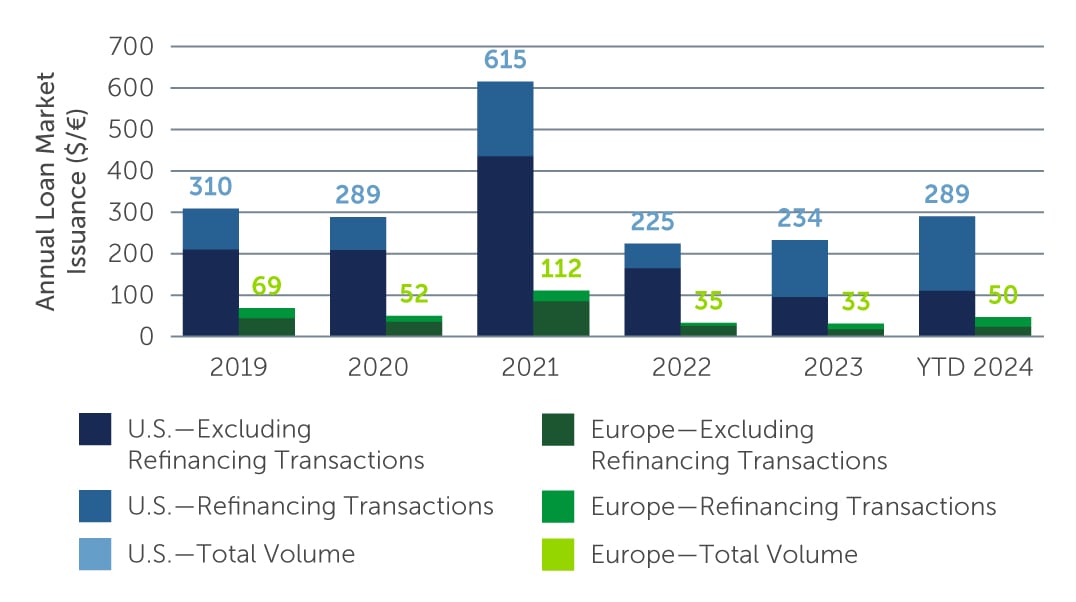

In terms of supply, new issuance has remained muted, exacerbated by the dearth of new issuance in the loan market amid lackluster M&A activity. Overall issuance has picked up, however, given the increase in refinancing and reset activity as managers look to capitalize on strong market conditions. In June in particular, refinancing activity outpaced new issuance by a ratio of 2:1 (Figure 1). Going forward, while refinancing and reset activity is likely to stay elevated with deals issued in 2022 reaching their non-call periods, we believe the combination of robust demand and limited new issuance will remain supportive of spreads and provide scope for further tightening—particularly in AAA tranches.

Figure 1: Refinancing Activity Dominates New Issuance

Source: Pitchbook LCD. As of June 30, 2024.

Source: Pitchbook LCD. As of June 30, 2024.

Wave of Defaults Unlikely

While there have been concerns that the higher-for-longer rate environment could weigh on companies who finance themselves through the leveraged loan market and potentially cause a wave of defaults, this has not materialized. The default rate for U.S. loans has increased slightly, but we do not expect it to exceed historical averages of between 3-5%.2 Additionally, the defaults that have occurred this year have been largely idiosyncratic in nature and often done through so-called distressed debt exchanges, an alternative to a formal restructuring in a bankruptcy court. A small number of borrowers that are facing more pressing challenges have also opted to engage in liability management exercises (LMEs) to proactively restructure their debt. LMEs tend to lead to more positive outcomes for CLO managers, particularly those that have experience in workout and restructuring scenarios. However, they can also impact recovery rates, which will likely be lower this cycle than the historical average of around 70%.3

Given these dynamics, there are some concerns around the proportion of CCC issuers in CLO portfolios, and whether that may be set to increase. However, we don’t believe this will create a major issue for the market, for a few reasons. For one, managers have the ability to actively trade around defaults and losses and, in preparation for a potential recession, have been more conservative in managing their CCC allocations over the last several years. CLOs also have robust structural protections in place that can provide additional credit support in periods of stress.

Favoring Quality & Liquidity

While opportunities continue to emerge across the CLO capital structure, our preference for quality and liquidity remains. Given that credit generally has continued to perform well, with spreads tightening across fixed income asset classes, most CLO tranches from both top and second tier managers, as well as across the capital structure, are trading close to par today and the basis between various profiles of deals and tranches has compressed. As such, now may not be the time to take on additional risk. In this environment, AAA-rated CLOs continue to look attractive from a risk-adjusted return perspective.

In the mezzanine part of the capital structure, we continue to see relative value in new issues from liquid, well-performing managers. More recently, we are also seeing select opportunities in high-quality refinancings and resets that have limited exposure to tail risk credits. Pricing in these transactions comes wide relative to pure new issues, and the time to close is typically shorter, allowing money to be put to work sooner. CLO equity also continues to look interesting. With strong underlying market conditions driving increased demand for CLO liabilities, liability pricing has become tighter, making the arbitrage for new issue equity more attractive than in recent years.

Looking Ahead

While credit markets overall have had a strong start to the year, CLOs continue to stand out given their floating-rate nature, robust structural protections, and attractive incremental yield potential relative to other fixed income asset classes. However, with risks on the horizon ranging from the U.S. presidential election to rising geopolitical tensions around the world, a disciplined approach—together with careful, bottom-up credit and manager selection—will be crucial to selecting the right opportunities going forward.

1. Source: J.P. Morgan. As of June 30, 2024.

2. Source: Barings. As of June 30, 2024.

3. Source: Barings.