IG Credit: Finding Value in a More Stable Environment

Record-high yields and supportive fundamental and technical factors continue to present opportunities in IG credit amid stabilizing spreads.

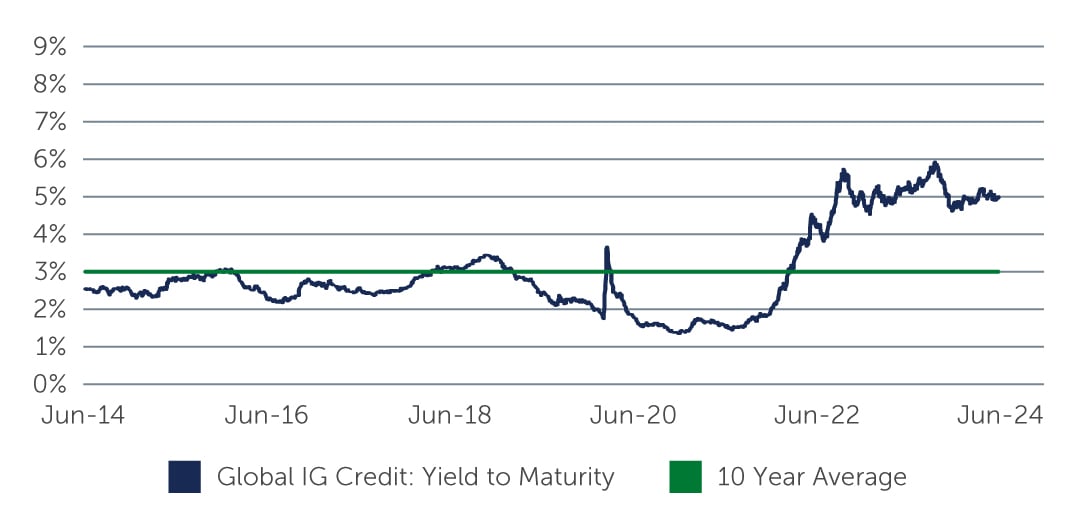

Slowly declining inflation and the U.S. economy’s ability to grow despite elevated real interest rates—the drivers of the U.S. Federal Reserve’s (Fed) current wait-and-see stance—have created a highly favorable environment for investment grade (IG) credit. Specifically, yields across the asset class have risen to 5.43%, a level rarely seen in the last 15 years and nearly double the 10-year average (Figure 1). While spreads remain tight compared to the beginning of this year, a continuation of the current economic and policy environment bodes well for IG going forward.1

Figure 1: IG Yields Remain Near Record-Highs

Source: Bloomberg, Barings. As of June 30, 2024.

Source: Bloomberg, Barings. As of June 30, 2024.

Positive Technicals, Stable Fundamentals

The technical backdrop remains supportive. With yields still elevated, investors have continued to gravitate toward IG corporate credit, with inflows in the first half of the year reaching $176 billion compared to $182 billion of inflows in all of 2023.2 Demand from insurers remains high as they seek to match liabilities coming from surging demand for fixed annuities in the current interest rate environment. On the supply side, the new issue market remains busier than expected, with issuance likely to stay elevated in the coming months due to the continued growth of the business development company (BDC) sector as well as the popularity of funding agreement-backed securities (FABS) issued by insurance companies. Nevertheless, second-half supply is forecast to be about 30% below that of the first half of the year, which would maintain the positive technical environment.

Another tailwind for the asset class is the overall fundamental picture. In the industrial sector, the slow erosion in fundamentals seen last year as leverage ticked up and interest coverage slipped seems to have leveled off—with leverage and interest coverage levels stabilizing at 3.3x and 9.6x, respectively.3 In financials, the deterioration was not as pronounced, and there too stability has set in. In addition, the ratings profile of the market remains the highest it has been since 2015, with the percentage of the IG universe rated BBB- at its lowest since then and the A-rated percentage at its highest.4

Opportunities Across the Market

While spreads have tightened across the market this year, and particularly in Europe, there is also a high degree of dispersion among spreads—and this continues to present compelling opportunities in IG credit. For instance, the unexpected announcement in June of a snap election in France resulted in some volatility in the European market, but this dislocation presented selective opportunities particularly in French issuers.

From a sector perspective, we continue to see ample opportunities in industrials and financials. Within financials, as mentioned earlier, there has been an uptick in new supply from under-followed and new issuers including insurance companies, BDCs, and real estate investment trusts (REITs). Given that there is less sell-side research covering these newer issuers, we believe that thorough, bottom-up credit research can uncover potentially overlooked opportunities for outperformance.

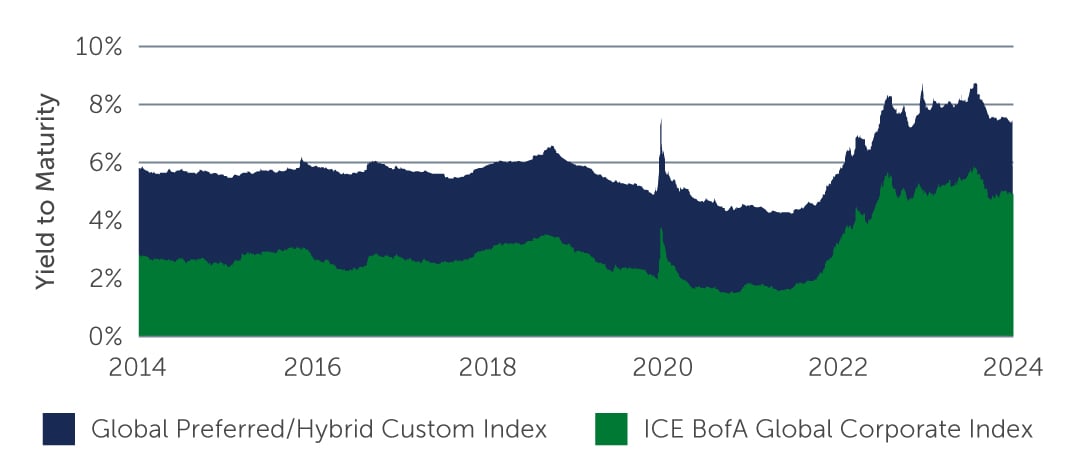

We also continue to see opportunities for potential spread pickup in capital structure trades (Figure 2). In particular, our research into IG-rated sub securities and hybrid securities has uncovered opportunities in shorter-duration bonds that we believe have a high probability of being called over the next two years, such as select AT1s and preferreds. For example, following the merger between Credit Suisse and UBS—which caused spreads to widen significantly across the European market—we identified attractive opportunities in shorter-dated AT1s from the national champion banks in Europe. We’re also seeing similar opportunities in the European energy sector, as many high-quality and defensive companies issue hybrid callable securities, which offer substantial spread pickup.

In addition, we believe corporate events such as M&A, tenders and bank liability management exercises (LMEs)—in which banks reduce debt by buying back bonds at a premium—offer the potential for spread tightening. For example, in the REIT space, we see opportunities particularly where there is potential for consolidation among triple-net lease REITs. Anticipating and predicting such corporate events enables investors to capitalize on any pricing inefficiencies that are created and avoid negative credit events.

Figure 2: Global Subordinated Bonds Have Historically Offered a Yield Advantage Over Global Corporate Bonds

Source: Bloomberg. As of May 31, 2024.

Source: Bloomberg. As of May 31, 2024.

On the Horizon

While the current environment is overall positive, there are a number of risks on the horizon—from the potential slowdown in economic growth to uncertainty around elections in the U.S. and Europe. This suggests that there could be bouts of volatility going forward, and subsequently a potential disruption to the current stable spread environment. With that potentially ahead, it may not make sense for investors to extend risk through lower ratings or longer duration. For now, with yields at historically attractive levels and with supportive fundamental and technical forces as a backdrop, investors would do well to focus on higher quality while also being open to opportunities that capitalize on market dislocations.

1. Source: Bloomberg. As of June 30, 2024.

2. Source: Bloomberg. As of June 30, 2024.

3. Source: J.P. Morgan. As of March 31, 2024.

4. Source: J.P. Morgan (ex-EM issuers). As of May 31, 2024